15 Apr Is the province stealing hundreds of millions from CBRM?

There’s a story going around Cape Breton that the province is cheating the Cape Breton Regional Municipality out of hundreds of millions of dollars per year in federal equalization payments to which our island is Constitutionally entitled.

The story is untrue. Among technocrats who understand how equalization works, and the much larger group with no patience for Cape Breton bellyaching, it elicits eye-rolling scorn.

But the story rests on a set of facts that can be assembled, or misassembled, into an easily understood and rational-sounding complaint with enduring emotional power. At the moment, it has hundreds, perhaps thousands, of Cape Bretoners fit to be tied.

Here’s the argument in a nutshell:

In the fiscal year that ended March 31, the province received $1.78 billion in Constitutionally required equalization payments from the Government of Canada, but turned over just $15.3 million to CBRM in municipal equalization. We got less than one percent of the total. With 14 percent of the province’s population, we should have received $249 million.

In the race for public opinion, a simple, emotionally appealing lie is out of bed and across town before a complex truth gets it sneakers laced up. Especially when, as in this case, explaining the complex truth quickly turns into the most boring civics class you ever endured.

The result? Nova Scotians for Equalization Fairness has formed; a Facebook page has launched; and angry screeds appear daily on social media and the pages of the Cape Breton Post almost daily.

“We’re being robbed systematically by the provincial government and they’ve been doing it since 1988 and it amounts to billions the CBRM has lost,” NSEF founder Fr. Albert Maroun told a recent meeting of the organization.

So what’s the real story? The Constitution Act of 1982 does indeed “commit” the federal government to the “principle” of making equalization payments that enable provinces to provide “reasonably comparable levels of public services at reasonably comparable levels of taxation.” It doesn’t spell out any mechanism, and the formula for fulfilling this commitment has continually changed.

Lately the province has been getting about $1.8 billion per year in equalization, but there is no requirement, nor any expectation, this money will be turned over to municipalities. In Nova Scotia, as in every have-not province, it goes into general revenues, and is spent throughout the province—including Cape Breton—on a host of provincial services.

Ottawa also gives Nova Scotia $966 million in the Canada Health Transfer, $357 million in the Canada Social Transfer, and a handful of smaller transfers. When combined with equalization, they add up to $3.29 billion, or about 29 percent of the provincial budget. Ottawa doesn’t even require this money to be spent on health, welfare, or higher education, its ostensible purposes, nor does it require equalization to be handed off to municipalities. The only requirements are that the province adhere to the principles of the Canada Health Act, and not establish a residency requirement for welfare programs.

Where do these federal transfers go? As Finance Minister Karen Casey wrote to Maroun, the funds:

…are used to provide programs and services to all Nova Scotians. They help pay for health care, education, community services, museums, libraries, roads, bridges, and other programs and services in all regions of the province, and I assure you that Cape Breton is treated the same as any other region. No region or municipal unit is given a specific allotment of the federal equalization funding.

It’s fair to say that Cape Breton receives hundreds of millions of dollars per year in provincial services of the kind Casey enumerates.

Now it happens that the province has an entirely separate program whose title also includes the word, “Equalization.” This is the relatively modest Municipal Equalization Program, whose goal is to help municipalities to provide similar level of local services for similar levels of property taxation. It’s under this program that CBRM received $15.3 million.

Now it happens that the province has an entirely separate program whose title also includes the word, “Equalization.” This is the relatively modest Municipal Equalization Program, whose goal is to help municipalities to provide similar level of local services for similar levels of property taxation. It’s under this program that CBRM received $15.3 million.

If that sounds like a small amount, bear in mind that CBRM gets almost half the entire $32.05 million budget for the program. You can imagine how other municipalities feel about CBRM’s complaint that it’s been robbed, when it gobbles up half the funds, year after year after year.

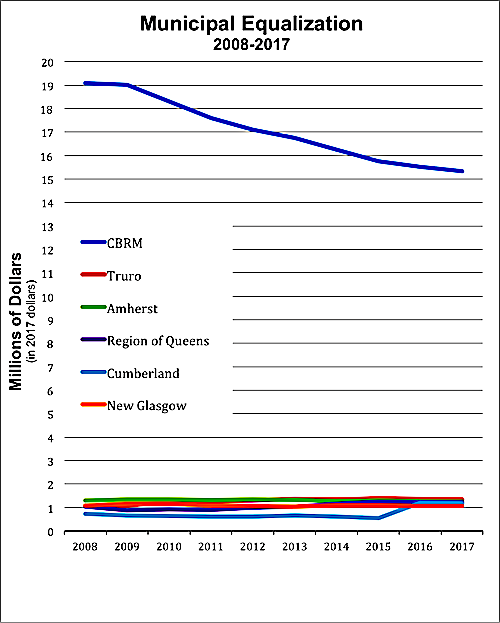

The chart at right shows the top six recipients of money under the program over the last 10 years. (I’ve adjusted the amounts to 2017 dollars to show how inflation has eroded its value over the years.) The decline in the real dollar amount of CBRM’s share roughly parallels the entire program’s decline over that period.

Here is where we get to the small germ of truth in the overblown, invidious complaints from Nova Scotians for Equalization Fairness. The Municipal Equalization program is underfunded. It doesn’t bring CBRM or the other have-not municipalities anywhere near a financial position that would enable them to fund similar services at tax rates similar to, say, Halifax. And since the dollar value of the fund has not changed in more than a decade, its buying power has fallen by about 14 percent.

This brings CBRM and all the other have-not municipalities up against the hard realities of governing in 2018. Health care takes 40 percent of the province’s budget, and government is under enormous pressure to improve health care. Education, another sore spot, takes 17 or 18 percent. Community Services takes nine percent, and it’s hardly lavish. Interest on the debt takes eight percent, a portion that’s sure to increase as interest rates begin to rise after a decade at record low levels. Transportation takes 4.5 percent. Think our roads and bridges are in good shape?

Add those up and you’ve burned through more than 80 percent of the provincial budget. Municipal Affairs is left to fight for scraps with the Seniors Secretariat, Fisheries, Environment, Agriculture, Natural Resources, Culture, Business, Justice, and half a dozen others. Each of those spending areas has a constituency that thinks it doesn’t get enough. Few Nova Scotians believe they are under-taxed.

If CBRM wants to move municipal equalization up the priorities list, it needs to stop caterwauling about injustice, unfairness, birthrights, Constitutional entitlements, and robbery, and start making common cause with the other municipalities to get this on the provincial radar. That’s called politics. It has little to do with fairness and everything to do with strategy and hard work.